Despite ongoing weakness in the stock, AT&T (T) is down following Q3 results. Investors were warned that the wireless giant has no answer to the overly competitive situation that will place the stock price under pressure despite the now substantial 5.8% dividend yield.

The stock trades down at $ 33.50 and at yearly lows. The question now is whether AT&T has taken enough of a hit considering the bundling of crucial services following the DirecTV merger aren’t apparently working.

The Q3 results were a big shock considering the wireless and video giant missed on both EPS and revenue estimates. More importantly, the company saw revenues plunge $ 1.2 billion and the only saving grace was that operating expenses declined by a nearly equal amount to produce a similar EPS total of last year at $ 0.74.

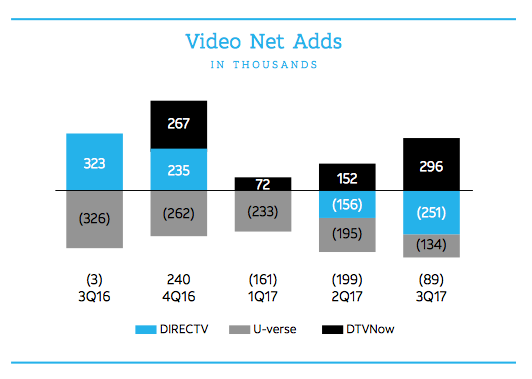

As the previous article highlighted, a primary area of weakness is the video business where cord cutters are at least shifting to the DirecTV Now service. Either way, the point of the DirecTV deal was to add pay-TV service to wireless consumers that used competitor offerings. Instead, AT&T lost 89,000 video subscribers last quarter and saw nearly 300,000 shift to the lower priced OTT service.

Source: AT&T Q3’17 Investor Briefing

Possibly even worse were the crucial post-paid phone net losses. The industry grew during Q3 so the weakness shows that AT&T is failing on marketing fronts while others are exploiting the situation. Walk Piecyk of BTIG tweeted these Q3 numbers by wireless provider showing an industry where AT&T is the only one shrinking.

These numbers really call into question the ability of management to select a merger target and execute on the integration. The upcoming Time Warner (TWX) merger should cast serious doubts on investors.

The company will turn focus to wrapping up regulatory concerns and deciding on content plans, instead of focusing on building the 5G wireless network or solving why bundling of wireless and pay-TV isn’t leading to industry leading customer additions.

For most investors, the question comes down to whether AT&T can continue paying the dividend. This isn’t always the most important question, but the market will focus on this issue.

The company pays a $ 0.49 quarterly dividend and earned $ 0.74 so the dividend appears to have decent coverage. AT&T spends about $ 3.0 billion in quarterly dividend payouts and the free cash flow is above that total YTD. The wireless giant has paid out $ 9.0 billion in dividends and generated $ 12.8 billion in free cash flow. The dividend payout ratio is up to 70.5% for the first nine months of 2017.

With annualized net EBITDA at over $ 52 billion and net debt at around $ 115 billion, AT&T doesn’t have any major leverage issues. The bigger concern is the dividend coverage if the competitive situation in the market gets worse. The 5.8% dividend appears more of a warning sign than an opportunity from that stand point.

The key investor takeaway is that industry consolidation such as a merger between Sprint (S) and T-Mobile (TMUS) could help alleviate the downside risk, but the merger with Time Warner just adds additional risk, debt and distraction. Until the competitive situation in the industry improves, AT&T remains a stock to avoid despite the high dividend yield.

Disclosure: I am/we are long TWX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Tech